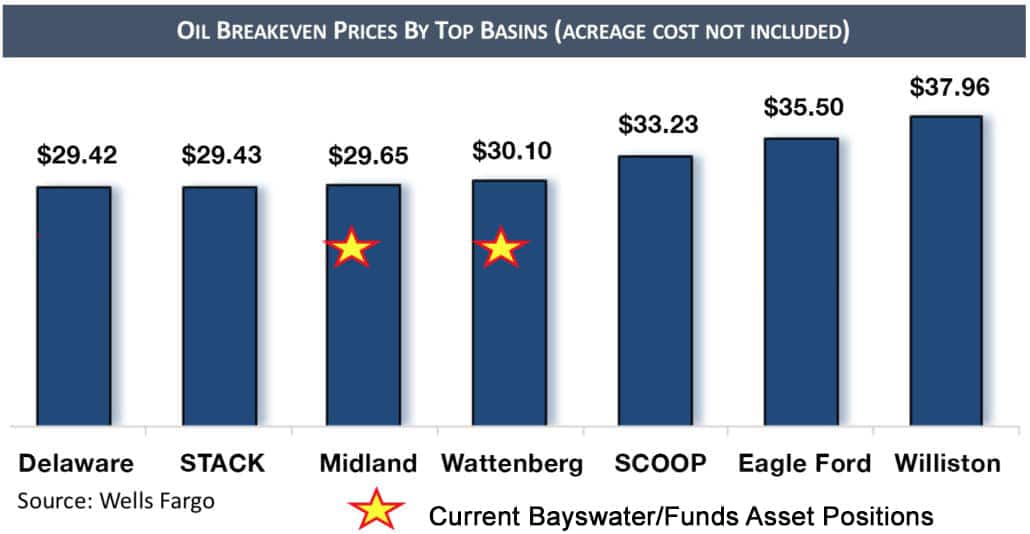

Bayswater has historically participated in plays and operated properties in a variety of basins and geographical areas. The hallmark of our current strategy is to focus on the top plays and basins within the United States. In general these plays typically:

- have the lowest breakeven costs;

- have the best type well economics; solid returns in the $35 to $50 WTI price environment;

- are supported by a robust and competitive service sector;

- have sufficient infrastructure to gather, process, and transport production to market; and

- have a history of industry players developing and utilizing over time, new or enhanced methods and techniques in drilling, and completing productive wells on a more cost-efficient basis.

Bayswater currently executes along four strategic themes:

- Building upon our long and successful track record in the DJ Basin by acquiring leasehold, drilling horizontal wells, and managing operations in core Wattenberg Field, Weld County, Colorado.

- Acquiring and developing leasehold in the Wolfcamp and Spraberry plays in the Northern Midland Basin, Howard County, Texas.

- Acquiring and developing “Tier Two” acreage positions, outside of the current core development areas in the top plays and basins, but possessing technical attributes that we believe could ultimately deliver Tier One / Core economic performance.

- Pursuing “New Opportunities in Old Fields” in older, established fields and play concepts, either currently producing or having demonstrated productive potential in the past, for which production can be enhanced or re-established through the application of modern technology and improved operations.